The proximity to New York (2 hour drive), lower income tax($100k for $1 million income in New York vs. $67k in CT), lower estate tax ($3.5 million for $25 million in New York vs. $2.5 million in CT), close-knit community and real estate that offers lavish 10-acre homes instead of cramped luxury apartments for the same price, pushed former fund managers to set their shop in Connecticut.

Connecticut is #1 in the US for per capita income, mostly, from the presence of the world’s leading hedge fund managers in Greenwich. If the hedge fund industry is taken out of the picture, the state still ranks #4 in the US, behind Maryland, Alaska, and New Jersey.

Hedge Fund

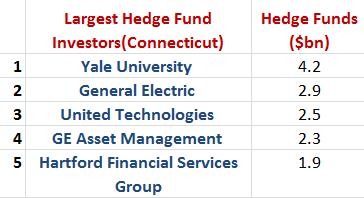

In terms of the total assets under management, Connecticut ranks #2 in the list of hedge funds in the US ($334 bn), behind New York, and well ahead of California. 202 hedge fund managers distributed across Greenwich, Stanford, and four other cities in the state, actively manage 616 Connecticut-based hedge funds.

The proximity to New York (2 hour drive), lower income tax($100k for $1 million income in New York vs. $67k in CT), lower estate tax ($3.5 million for $25 million in New York vs. $2.5 million in CT), close-knit community and real estate that offers lavish 10-acre homes instead of cramped luxury apartments for the same price, pushed former fund managers to set their shop in Connecticut.

The strength of the Finance industry in the state comes from the larger demographic working in the sector (20%), even higher than New York City (12.4%).

Incentives in New Jersey and Florida have not led to a mass migration of Hedge fund giants precisely due to his reason. The skills required to create finance models using machine learning, execute complex investment strategies, follow regulatory compliance, complete deep research and develop quant models, are not easily available outside New York City. Handling billion dollar funds require talents who had prior experience in NYSE – a factor that has kept Connecticut at a strategic advantage.

Insurance

With the legacy of witnessing, the world’s first property insurer – The Hartford, Connecticut, employs over 200,000 employees in the sector and drove the growth of related sub-sectors - technology, legal and accounting in the state. The highest concentration of actuaries and insurance professionals in the US has helped the state generate $13.7 billion towards the state’s GSP (Gross State Product), supported by 1429 state insurance companies, that in 2015 sold over $32.8 billion in annual premiums.

For MBAs entering the industry in the state, the compensation is the best in the US with the average pay for the management professionals (the 2nd largest group in the Business) at $157,483 for 2016. Technology and Math graduates are the 3rd largest group in the industry, primarily to fill the need to develop mobile applications, security suites, predictive models, AI-based assistants and health tracking software systems.

Reference

The Hedge Fund Industry in Connecticut

Hedge Funds to Hedge Rows

About the Author

I am Atul Jose - the Founding Consultant at F1GMAT.

Over the past 15 years, I have helped MBA applicants gain admissions to Harvard, Stanford, Wharton, MIT, Chicago Booth, Kellogg, Columbia, Haas, Yale, NYU Stern, Ross, Duke Fuqua, Darden, Tuck, IMD, London Business School, INSEAD, IE, IESE, HEC Paris, McCombs, Tepper, and schools in the top 30 global MBA ranking.

I offer end-to-end Admissions Consulting and editing services – Career Planning, Application Essay Editing & Review, Recommendation Letter Editing, Interview Prep, assistance in finding funds and Scholarship Essay & Cover letter editing. See my Full Bio.

I am also the Author of the Winning MBA Essay Guide, covering 16+ top MBA programs with 240+ Sample Essays that I have updated every year since 2013 (11+ years. Phew!!)

I am an Admissions consultant who writes and edits Essays every year. And it is not easy to write good essays.

Contact me for any questions about MBA or Master's application. I would be happy to answer them all