Despite a budgetary surplus in 2019, wage growth, and lower unemployment rate, 2019 Q3 saw Germany saving itself from a technical recession through thin life support of 0.1% growth. The weak global auto demand, disruption in trade with Brexit and political uncertainties in the country, were all factors but the ride-sharing apps dominance, increased competition from China & South East Asia in Manufacturing, and the subdued growth of emerging and developed economies led to lower demand for the manufacturing industry – the leading exporter in Germany. The government estimated a modest 1.2% GDP growth for 2020.

Despite a budgetary surplus in 2019, wage growth, and lower unemployment rate, 2019 Q3 saw Germany saving itself from a technical recession through thin life support of 0.1% growth. The weak global auto demand, disruption in trade with Brexit and political uncertainties in the country, were all factors but the ride-sharing apps dominance, increased competition from China & South East Asia in Manufacturing, and the subdued growth of emerging and developed economies led to lower demand for the manufacturing industry – the leading exporter in Germany. The government estimated a modest 1.2% GDP growth for 2020.

Manufacturing

From mass production to automation to intelligent machines, the Industry 4.0 was spearheaded by the Germany government with the unveiling of the idea in the 2011 Hanover Fair that become a policy document in 2013 when the government began focusing on improving the stagnant productivity in factories, despite automation, by introducing ‘smartness’ and de-centralized processes in the manufacturing process and supply chain. The safe virtual environment to test multiple design ideas and simulation models addressed the high cost of testing. Taking a leaf from software development, manufacturing scaled modularity into the process with secure cloud services, that does a better job in driving real-time data collection and analysis. The digitization projects in Consulting are mostly focused on developing this capability.

Germany has strategically adopted Industry 4.0 to counter the increased threat of the Chinese supply chain, and a greater call for sovereignty over European union. The large share of the investments has been in the home country and capacity extension closer to the market. The offshore model is not redundant yet, but the strategic investments with just 12% return over 5-years, indicate that Germany is developing a contingency plan to handle unpredictable political, health or economic event in China.

IoT and IIOT

Internet of Things (IoT) and Industrial Internet of Things (IIOT) has transformed from a hyped term to a reliable market with Munich and Frankfurt embracing the technology to augment their automotive and manufacturing industries. IBM was among the first multinational to foresee the potential while establishing its Global Watson IoT unit in Munich, way back in 2015, and also establishing its first European Watson Innovation Center – a 1000 strength campus. Cisco followed suit and pledged to invest $500M through Deutschland Digital, with priority assigned to IoT, cloud computing, and security. With IIOT, projected to reach a $5T market with the wide integration of 5G technology, Germany’s leadership in Big data had a ripple effect on adjacent industries.

Technology

The slowing manufacturing industry, stabilizing enterprise technology, and the greater influence of digital companies over citizen’s behavior and choices (payment, entertainment, and communication) have vitalized the government to invest in its digital economy. To foster innovation, Germany has introduced De: Hub – a silicon valley equivalent cluster, distributed in 12 hubs around the country by taking advantage of each region’s strength.

1. Hamburg - Logistics

2. Berlin - IoT and FinTech

3. Potsdam - MediaTech

4. Dortmund - Logistics

5. Dresden Leipzig - Smart Systems and Smart Infrastructure

6. Cologne - InsurTech

7. Frankfurt - FinTech and Cybersecurity

8. Mannheim - Digital Chemistry and Health

9. Nuremberg - Digital Health

10. Karlsruhe - AI

11. Stuttgart - Future Industries

12. Munich - Mobility and Insurance Tech

FinTech

German regulatory body, BAFin’s tough approach to FinTech startups, has discouraged many international FinTech startups from finding viable alternatives to London or San Francisco or New York, in Berlin.

In addition to the regulatory challenges, FinTech companies start off as a join partnership with traditional banks, before VC backed funds could take the companies as their own banking eco-system. Apart from Deutsche Bank, the top 10 European region banks find their base in the UK and France. This trend was visible in 2019 when German companies closed 37 deals. Although the number was way behind the 114 deals London-based FinTech companies closed, the total deal size of $1 bn was comparable to market leaders’ $2bn. Like other countries, the largest growth has been in the blockchain ecosystem (111% growth 2017-2019), followed by Financing, Investment, InsureTech, and Property Technology.

N26’s $300 million funding round in 2019, paused the world’s investing communities to take notice of Berlin’s FinTech growth and the stability in building FinTech platforms like AUTO1 (car financing) that registered a 580% growth in 2019, encouraging established FinTech companies to find base in Germany for their European expansion plans.

Management Consulting

Since most consulting services are in Digital transformation and digitizing Financial services, Germany, which had a head start from the Industry 4.0 revolution, is at the middle of the pack, compared to other European markets, with CAGR at 7.7% in 2019, behind France, Austria, Hungary, Greece, Italy, and Romania. The political uncertainties and Brexit have forced consulting companies to focus on local fund allocation and demand, especially in pension, childcare, and long-term healthcare with digitization and consultation for infrastructure projects in energy, transportation, and childcare.

Despite modest median base salary for top MBA programs in Germany – Mannheim ($103,200 – average) ESMT ($91,551 - average), WHU ($82510), Frankfurt ($78,359), HHL ($70,633), the Management Consulting industry in Germany is bullish on recruitment with 90% of consulting company (over $11M revenue) and 75% of companies (less than $5M) are planning to create positions for senior consultants – the likely designation for post-MBA graduates.

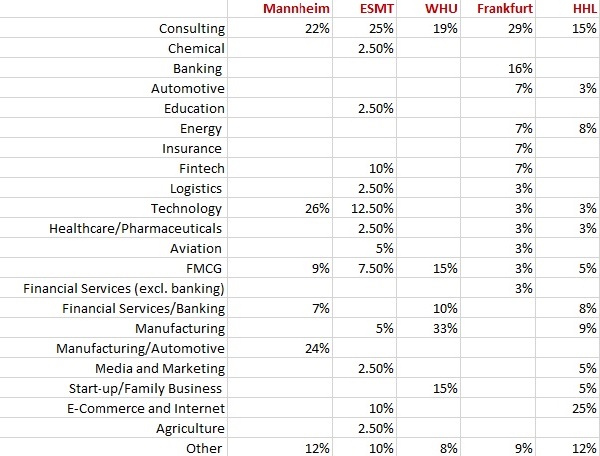

Post-MBA industries (German Top Schools)

The post-MBA industries influence the diversity of the consulting recruiters.

With Mannheim, Frankfurt, and ESMT MBA programs, applicants can expect a healthy 20%+ recruitment into the consulting industry. For technology and E-Ecommerce, Mannheim and HHL have over a quarter of the class opting in. Frankfurt School of Finance and Management, as expected, has over 16% in banking, 7% in Insurance, and 7% in FinTech, making the program an attractive career-boosting platform for Finance professionals. WHU clearly is a hub for professionals interested in entering Manufacturing with over 33% gaining placement in the industry. FMCG is the third popular industry attracting 15% from WHU, 9% from Mannheim, and 7.5% from ESMT.

Overall, only Mannheim crossed the $100,000 barrier with ESMT at $10,000 behind on base-salary.

Reference

Despite a budgetary surplus in 2019, wage growth, and lower unemployment rate, 2019 Q3 saw Germany saving itself from a technical recession through thin life support of 0.1% growth. The weak global auto demand, disruption in trade with Brexit and political uncertainties in the country, were all factors but the ride-sharing apps dominance, increased competition from China & South East Asia in Manufacturing, and the subdued growth of emerging and developed economies led to lower demand for the manufacturing industry – the leading exporter in Germany. The government estimated a modest 1.2% GDP growth for 2020.

Despite a budgetary surplus in 2019, wage growth, and lower unemployment rate, 2019 Q3 saw Germany saving itself from a technical recession through thin life support of 0.1% growth. The weak global auto demand, disruption in trade with Brexit and political uncertainties in the country, were all factors but the ride-sharing apps dominance, increased competition from China & South East Asia in Manufacturing, and the subdued growth of emerging and developed economies led to lower demand for the manufacturing industry – the leading exporter in Germany. The government estimated a modest 1.2% GDP growth for 2020.