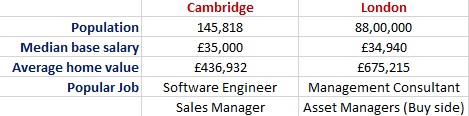

Location

Although Software Engineer was the most lucrative job at Cambridge, the top performing company at Cambridgeshire was the Pharma Giant -AstraZeneca PLC that relocated to the University town at the strategic Cambridge Biomedical Campus (CBC). The MedImmune wing of the company already employs over 2,000 clinicians and scientific team in the city, but with the relocation, the company seeks to utilize the rich scientific heritage of the university.

Recently, the city gained renewed interest with the influx of Tech Giants – Microsoft, Apple, and Amazon, to host the next generation technologies – AI and Driverless cars. Along with the giants, smaller tech firms has pushed the total value of the cluster to over £2.1bn – a 30% year on year growth and employing over 30,000 people. Traditionally known for agriculture-related products and services, Cambridge is diversifying into Aerospace & Defense, Pharma, and Technology – reflecting the larger UK trends.

London, on the other hand, is the #1 Financial capital of the world. After four years of stagnant growth (0.9%), the Financial Services industry experienced an unprecedented 15.8% growth to reach export targets of £95.7bn. When the world was doubting UK's role in the Global Economy following Brexit, the FinTech investors was beyond optimistic in 2017 with the UK Financial Technology companies receiving over £1.8 billion in VC funds - a 153% year on year growth.

The sub-sectors within FinTech to see the most traction was in Digital Banks, Foreign Exchange Providers, and Money Transfer operators that attracted 45% of all the investments. London was the focal point attracting 90% of the total investments in the sector.

Asset Management and FinTech were the two most promising career paths in London, both earning MBA candidates over £100,000 with performance and sign-on bonuses. Management Consultants serving the Technology and Financial services industry also crossed the £100k total compensation. However, when you list the top 10 companies originating from London, the spread of the industry is as diverse as banking, pharma, insurance, communication, petroleum, and mining.

For Complete Analysis of Top Industries in the UK, Download MBA in the UK (2018) - Industry Analysis (PDF)

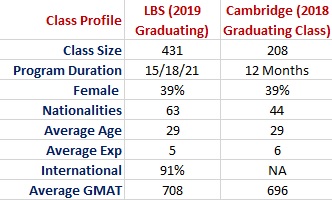

Class Profile

London Business School MBA program offers the flexibility of three schedules – the 15-month/18 or the 21-month MBA program with the longer duration, offering internship opportunity. Those who would like to switch careers should consider the longer term while those who want to continue in the current industry but switch within it to niche sub-industries like FinTech, should choose the shorter duration.

London Business School MBA program offers the flexibility of three schedules – the 15-month/18 or the 21-month MBA program with the longer duration, offering internship opportunity. Those who would like to switch careers should consider the longer term while those who want to continue in the current industry but switch within it to niche sub-industries like FinTech, should choose the shorter duration.

The average years of experience and age are similar in the two MBA programs. However, Cambridge is chosen by candidates with relatively more experience.

Based on the international students in the class (91%) and the nationalities represented (63), London Business School has more diversity.

The entry criteria are stricter on the GMAT front at LBS with 708 while at Cambridge the mean is at 696. The GPA is more lenient at LBS although the average falls in the 3.4 to 3.6 range. Cambridge MBA team has not published the range, but we noticed that applicants with a greater shot at Scholarships at Cambridge MBA have a GPA of over 3.7

Class Size: LBS MBA > Cambridge MBA

Nationalities: LBS MBA > Cambridge MBA

Average GMAT: LBS MBA > Cambridge MBA

Female Candidates: Both the MBA programs have an equal percentage of female candidates at (39%) with Cambridge increasing the intake by 6% in just a year.

Note: Entry Criteria is the first roadblock that you have to consider for getting into Cambridge or LBS MBA, but if your GMAT score is above the class average by 30-50 points, admission chances depend on what relevant life stories you capture in the essay. Share your profile summary here and start a conversation with us. We will improve your admission chances for LBS or Cambridge MBA.

Pre-MBA Industry

Switching industries is extremely tough in shorter MBA program unless you can leverage all the opportunities offered in the curriculum (experiential learning and internships). That is one reason you see a large percentage from the Finance industry (26 to 27%) in both the program – a group that tends to be career enhancers.

Consulting is another industry that has experienced net positive migration.

Technologists and Software Engineers targeting London Business School MBA program should be aware of the low percentage from the industry. The program places 67% in Finance and Consulting – both requiring specialist skills and personality traits that are vital for success (analytical – Finance and probing & extroversion – Consulting). Candidates from Technology are stereotyped as introverts with limited cross-domain knowledge.

Note: Pre-MBA industry representation should have given you a realistic perspective on your admission chances. A low percentage (less than 10%) from your industry should not discourage you but help you develop a strategy to approach the admission process. We can help you. Start here

Pre-MBA Industry (Consulting): LBS MBA > Cambridge MBA

Pre-MBA Industry (Finance): Cambridge MBA > LBS MBA

Pre-MBA Industry (Public sector/Non-Profit): Cambridge MBA > LBS MBA

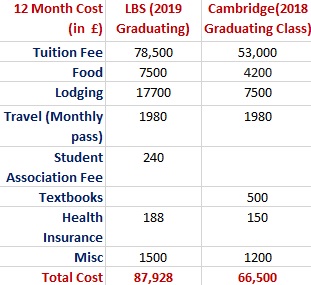

Cost LBS MBA program is offered in 15-month, 18-month or 21-month duration. We have calculated the cost for the 15-month program for a Single person, for a scenario where the student opts for a single bedroom private apartment outside London City Centre at £1,180 per month.

LBS MBA program is offered in 15-month, 18-month or 21-month duration. We have calculated the cost for the 15-month program for a Single person, for a scenario where the student opts for a single bedroom private apartment outside London City Centre at £1,180 per month.

The largest component of the expense apart from the tuition fee is the Lodging with the stay in the city center crossing £1600 per month. The tuition fee at London Business School is one of the highest in the world at £78,500 or $109,450 regardless of the program length you choose.

Although the tuition fee is the largest element of the cost, compared to London Business School, the fee is £25,000 lighter on the purse. The total cost for the 12-month Cambridge MBA can range from £66,550 to £77,500, depending on the family status.

The Cambridge MBA program provides in-college accommodation with shared facilities, helping candidates reduce their lodging cost by 1/3rd. For those who want privacy or have a family accommodation, the cost can go upwards of £9,500.

Total Cost: Cambridge MBA < LBS MBA

Lodging Cost: Cambridge MBA < LBS MBA

Tuition Fee: LBS MBA > Cambridge MBA

Note on Cost (London): Keep in mind that, excluding rent, the average expense per person is £9,072 in London and can run up to £32,604, for a family of four.

Reference

MBA in the UK (2018) - Industry Analysis, MBA Comparison and Funding (PDF)

Top 25 Companies Based in London

Top 100 companies in Cambridgeshire revealed

LBS MBA

Cambridge MBA

Business School